In Australia, approximately 1 in 3 workers have reported losing sleep due to financial worries. About 64% of employees in Australia state that their current financial concerns have a negative impact on their job performance.

Australia loses an estimated 25 million working hours each year due to financial stressr among its workforce.

In response to these concerns, an increasing number of Australian companies are focusing on financial well-being programs. As of now, 95% of companies in Australia have intentions to implement such programs, marking a significant increase from the 55% reported a year ago.

Supporting Employees In Financial Distress: How And When To Step In

In today’s dynamic economic landscape, many employees face financial challenges that can impact their overall well-being and job performance. As employers, it’s crucial to recognize the signs of financial distress and proactively offer support to help your team members navigate these difficulties. This article will explore the strategies and timing for providing assistance to employees who are struggling financially.

Identifying Financial Distress

Performance Decline: One of the primary indicators of financial distress is a decline in job performance. Employees may find it difficult to concentrate on their work when they are grappling with financial worries.

Frequent Absences or Tardiness: Financial stress can lead to increased absenteeism or tardiness as employees deal with personal financial matters during working hours.

Requests for Advances or Loans: When employees start requesting advances on their salaries or loans, it’s a clear sign that they may be facing financial difficulties.

Changes in Behavior: Observe changes in behaviour, such as increased anxiety, stress, or mood swings, which can be linked to financial worries.

How To Offer Support

Open Communication: Create a workplace culture that encourages open and non-judgmental communication. Let employees know they can talk to you or HR about their financial concerns confidentially.

Financial Wellness Programs: Implement financial wellness programs that provide resources, workshops, and tools to help employees manage their finances better.

Flexible Work Arrangements: Consider offering flexible work arrangements, such as adjusted hours or remote work options, to accommodate employees’ needs during times of financial stress.

Access to Counseling Services: Partner with Employee Assistance Programs (EAPs) to offer counseling services to employees dealing with financial stress.

Emergency Funds: Establish an emergency fund or financial assistance program for employees facing extreme financial hardship.

When To Step In

Early Intervention: It’s best to intervene at the earliest signs of financial distress to prevent the situation from worsening and impacting job performance.

During Performance Reviews: Use performance reviews or one-on-one meetings as an opportunity to discuss any concerns related to an employee’s financial well-being.

Trigger Events: Certain life events, such as a divorce, medical emergency, or unexpected job loss in the family, can be triggers for financial distress. Be especially attentive during these times.

Employee Outreach: Regularly check in with employees and encourage them to reach out if they are facing financial difficulties. Make sure they are aware of the support and resources available.

The Vital Role Of Payroll In Elevating The Employee Experience

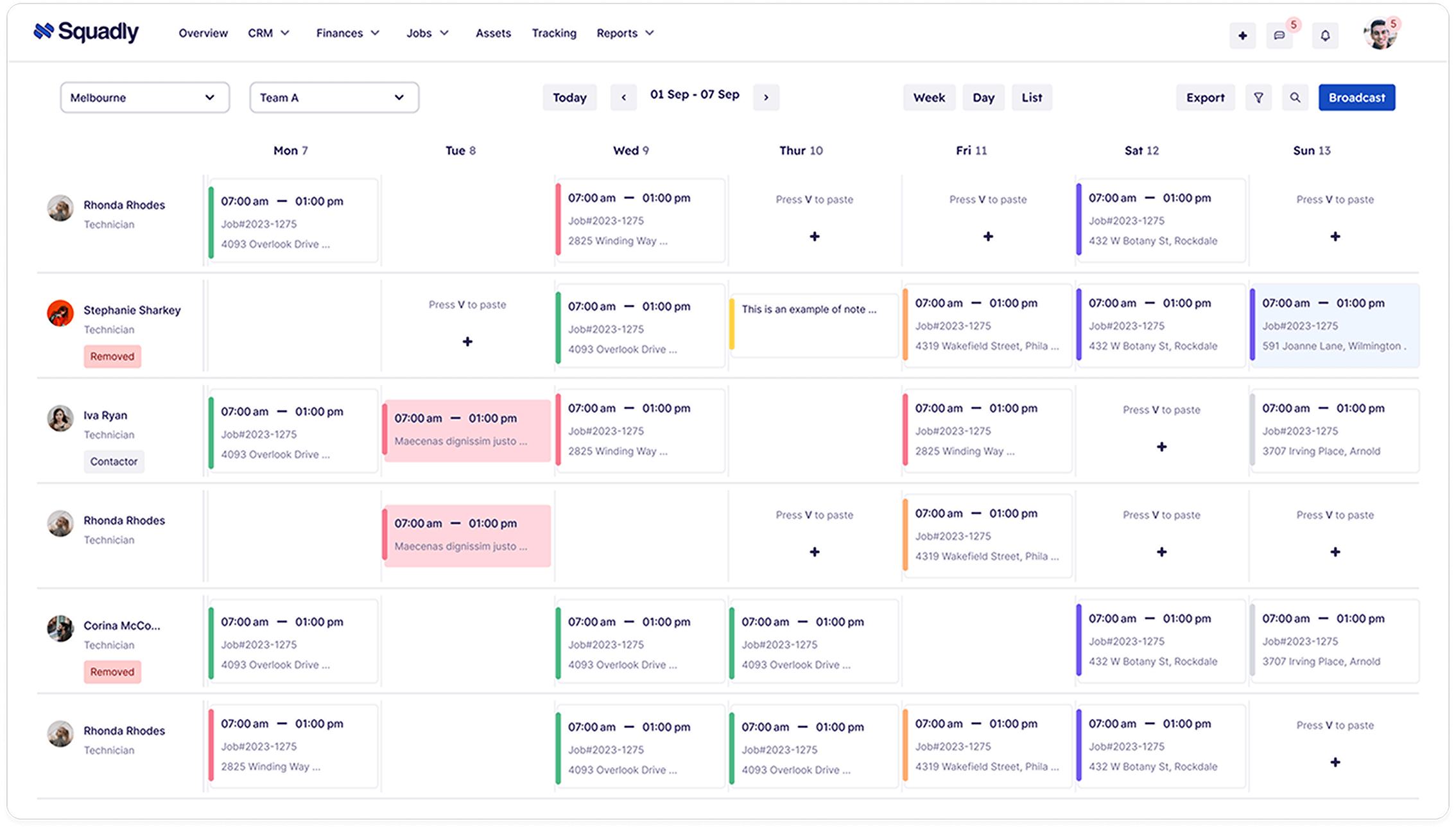

The employee experience is a multifaceted aspect of modern workplaces that encompasses everything from company culture to benefits and beyond. One often underestimated but critically important element of the employee experience is payroll. Payroll isn’t just about issuing paychecks; it plays a pivotal role in shaping how employees perceive their workplace and can significantly influence job satisfaction and overall well-being.

Accurate And Timely Payments

One of the most fundamental ways in which payroll enhances the employee experience is by ensuring that employees are paid accurately and on time. Late or inaccurate paychecks can lead to frustration, stress, and a loss of trust in the employer.

Transparency And Trust

Transparent payroll processes build trust between employees and their employers. When employees understand how their compensation is calculated, including deductions and benefits, it fosters transparency and reduces confusion or suspicion.

Benefits Administration

Payroll is closely linked to benefits administration. Managing benefits effectively through payroll systems ensures that employees have access to healthcare, retirement plans, and other essential benefits. Offering a well-structured benefits package can significantly boost employee satisfaction.

Tax Compliance

Ensuring compliance with tax regulations and withholding the correct amount of taxes from employee salaries is vital. Mishandling taxes can lead to legal issues for both employees and employers, causing stress and dissatisfaction.

Customized Payroll Options

Modern payroll systems offer flexibility, allowing employees to customize certain aspects of their payroll, such as allocation to savings accounts or different payment frequencies. Providing these options empowers employees to manage their finances according to their preferences.

Payroll As An Employee Engagement Tool

Effective payroll systems can be used as tools to engage and motivate employees. For instance, offering performance-based bonuses or incentives through the payroll system can incentivize employees to excel in their roles.

Efficiency And Error Reduction

Streamlined payroll processes reduce administrative errors, such as miscalculations or missed payments. When employees receive their paychecks accurately and consistently, it contributes to a smoother and more positive experience.

Security And Data Protection

Protecting sensitive financial information is crucial for both employees and employers. Robust payroll systems prioritize data security, safeguarding personal and financial details, which in turn enhances employees’ confidence in their workplace.

Employee Self-Service Portals

Many modern payroll systems come with self-service portals that allow employees to access their payroll information, view pay stubs, and make updates to their personal details. This self-service functionality empowers employees to take control of their payroll-related needs.

Nurturing Employee Well-Being In Challenging Times

In an era where economic challenges can cast a shadow on the workplace, it’s imperative for employers to take proactive steps to ensure the well-being and satisfaction of their workforce. Australia, like many other nations, faces the reality of employees grappling with financial worries and stress, which can have profound implications for their performance and overall job satisfaction.

Recognizing the signs of financial distress and knowing how and when to offer support is a pivotal aspect of responsible and compassionate leadership. Employers must foster a culture of open communication, providing resources, flexibility, and access to professional assistance when needed. Early intervention and sensitivity to trigger events are critical in preventing financial worries from escalating and impacting an employee’s ability to excel in their role.

Additionally, the role of payroll in shaping the employee experience cannot be underestimated. Timely and accurate payments, transparent processes, and efficient benefits administration are key contributors to employee satisfaction and trust in the workplace. Modern payroll systems offer not just financial transactions but opportunities for engagement, customization, and empowerment, allowing employees to manage their finances with ease.

Ultimately, a workplace that prioritizes the financial well-being of its employees through both proactive support and effective payroll management fosters an environment where individuals can thrive even in challenging economic times. By investing in the holistic well-being of their workforce, Australian companies can position themselves as employers of choice, attracting and retaining top talent, and nurturing a resilient and contented team ready to face the future with confidence.